Under the PENJANA stimulus package this limit is increased to RM3000 to be provided until the end of 2022. If more than one individual claims for this deduction the amount has to be equally divided according to number of individuals claiming for that same parent.

Books journals magazines printed newspapers sports equipment and gym membership fees.

. Extension of period for tax relief in respect of net annual contributions to the national education savings scheme Skim Simpanan Pendidikan NasionalTo further encourage parents to save for the costs of their childrens higher education fees the tax relief of up to RM8000 will be extended until year assessment year 2022. KISS Kasih Ibu Smart Selangor The program aims to reduce the cost of living through financial aid for the purchase of basic necessities. Higher tax relief limit for payments of nursery and kindergarten fees extended Parents paying fees to registered childcare centres are originally allowed to claim of up to RM2000.

Dependents Disabilities 2. On top of that the parents shall be residents in Malaysia and the medical treatment or care services must be provided in Malaysia. March 10 2022 For income tax in Malaysia personal deductions and reliefs can help reduce your chargeable income and thus your taxes.

If planned properly you can save a significant amount of taxes. Fathers in Malaysia can expect to have seven days of paternity leave up from three days while mothers can expect 98 days of maternity leave up from 60. Tax Relief for Parents i Medical expenses for parents RM 8000 Including medical treatment expenses special needs or carer expenses Tax relief for parental care is not available now Tax Relief for Whole Family Individual spouse and child i Education or medical insurance RM 3000 Insurance premium for education or medical benefit.

They may feel fear and grief over the impact of the virus on their families. There are personal reliefs that every taxpayer in Malaysia can deduct once their income reaches the chargeable income level. Your parents also need to be individuals residing in Malaysia and the medical treatment and care services are also provided in Malaysia.

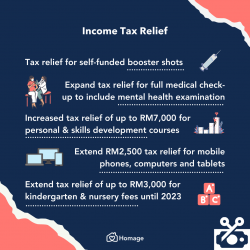

He added that the tax relief for a full health screening would be increased from RM500 to RM1000. More Information visit JKM Portal - Bantuan Orang Tua 3. Objective of this aid is for senior citizen to live and lead a normal life with care and support from local community.

Self and spouse rebates. Child Below 18 years old. The conditions of entitlement for each relief must be satisfied in order to minimize the income tax liability.

Companies are not entitled to reliefs and rebates. Those who have received their Income Tax Return EA Form can do this on the ezHASiL portal by logging in or registering for the first time. Fathers in Malaysia can expect to have seven days of paternity leave an increase from the previous three days after an amendment to the Employment Act 1955 Act 265 was tabled and.

Purchase of basic supporting equipment for disabled self spouse child or parent For this tax relief claim the purchase of any necessary basic supporting equipment is allowed as a deduction if. Amendments in tax reliefs have been made this YA. There are various items included for income tax relief within this category which are.

Other ways to cut your payable taxes. Due to the spread of coronavirus disease COVID-19 children are affected by physical distancing quarantines and nationwide school closures. Up to RM9000 Granted automatically to an individual for themselves and their dependents.

While tabling the 2020 Budget in Parliament today Finance Minister Lim Guan Eng said the move will help ease their financial burden. This relief is applicable for Year Assessment 2013 and 2015 only. For YA 2021 extended until YA 2023.

About the Company Malaysia Tax Relief Parental Care. Parents who send their children to daycare centres and kindergartens will enjoy double the amount of individual tax relief from the current RM1000 to RM2000. The allowable relief is RM1500 for one mother and RM1500 for one father.

Expansion of scope and ncrease in tax relief for medical expenses on i serious. KUALA LUMPUR Oct 15 Instead of RM1000 as previously implemented parents can now claim a tax relief of RM2000 if they have a six-year-old child sent to a kindergarten or pre-school registered with the Department of Social Welfare JKM. Special relief of RM2000 will be given to tax payers earning on income of up to RM8000 per month aggregate income of up to RM96000 annually.

You can also get an extra RM400 if your spouse has no income. This can only be claimed by either the mother or father. This tax relief has been increased to a limit of RM3000 for parents sending their kids to a childcare centre or kindergarten.

Tax season will be coming up soon for Malaysians making an income of at least RM34000 for the Year of Assessment YA 2021. The education tax relief for your children falls under Parenthood which we will cover below. The tax relief on expenses for medical treatment special needs and parental care will also be raised from RM5000 to RM8000 he said during the tabling of the Budget 2021 in parliament on Friday Nov 6.

This deduction can only be claimed by either the mother or father. It was established in 2000 and has since become a participant in the American Fair Credit Council the US Chamber of Commerce and accredited with the International Association of Professional Debt Arbitrators. Self Parents and Spouses Automatic Individual Relief Claim allowed.

RM1500 per parent only allowed if no claims made under medical expenses for parents. Personal Tax Reliefs in Malaysia Reliefs are available to an individual who is a tax resident in Malaysia in that particular YA to reduce the chargeable income and tax liability. Increase in tax relief for medical treatment special needs and parental care ex penses It is proposed that the income tax relief for medical treatment special needs and parental care expenses be increased from RM5000 to RM8000 with effective from YA 2021.

For expenses incurred during the period 1 March 2020 until 31 December 2021 extended to 31 December 2022. Medical Expenses for Parents. The tax relief is among the provisions contained in the Finance Bill 2019 tabled in the Dewan Rakyat.

RM2000 Each unmarried child who is under the age of 18 years old. 2 This income tax relief can be shared with other siblings provided that the total tax relief claimed does not exceed MYR 1500 for. CuraDebt is a company that provides debt relief from Hollywood Florida.

Computer annually payment of a monthly bill for internet subscription Smartphones The maximum income tax relief amount for the lifestyle category is RM2500. For public servants under the pension scheme combined relief up to RM7000 is given on Takaful contributions or payment for life insurance premium. Some children and young people may be feeling more isolated anxious bored and uncertain.

If your income does not exceed RM35000 a year youre eligible to receive a rebate of RM400.

Malaysia Personal Income Tax Relief 2021

The New Mom S Survival Kit What You Need Postpartum Themonarchmommy New Mom Survival Kit Epsom Salt Epsom Salt For Hair

Malaysia Personal Income Tax Guide 2020 Ya 2019 Yh Tan Associates Plt

Sudocrem Healing Cream For Nappy Rash 60g Nappy Rash Skin Care Specials Emollient Cream

2020 Tax Relief What To Claim For Your Tax Deductions R Malaysia

9 Ways To Maximise Income Tax Relief For Family Caregivers In 2022 Homage Malaysia

Johnson S Moisturizing Bedtime Baby Lotion Paraben Free 27 1 Fl Oz Walmart Com In 2022 Baby Lotion Baby Skin Care Paraben Free Products

Rinkmo Vanity Makeup Mirror Mirror With Lights Makeup Mirror With Lights Living Room Furniture Sale

How To Maximise Your Malaysian Tax Relief And Tax Rebates For Ya2020 Mypf My

Amazin Graze Graze Lululemon Logo Retail Logos

Water Washed Indoor Air Sick Building Syndrome Rainbow Vacuum Rainbow Vacuum Cleaner

Baby Teething Mitten Baby Teething Toys Baby Gloves Teething Mittens

9 Ways To Maximise Income Tax Relief For Family Caregivers In 2022 Homage Malaysia

9 Ways To Maximise Income Tax Relief For Family Caregivers In 2022 Homage Malaysia

Asthma Action Plan Template Lovely 10 Allergy Action Plan Templates Doc Pdf Action Plan Template How To Plan Event Planning Checklist Templates

Malaysia Personal Income Tax Relief 2022

Happy Event Firming Cream Review Kaboutjie Firming Cream Massage Lotion Cream

9 Ways To Maximise Income Tax Relief For Family Caregivers In 2022 Homage Malaysia